Keep track of your businesses finances using our FREE cash book template.

AUTO ENROLMENT SERVICES

5 Star Defaqto Rating and Pension Regulator Approval

Automatic or Auto Enrolment has been introduced by the Government to help people save for later life but with it comes a number of mandatory obligations that will be imposed on employers of all sizes, whether they have 1 or 1,000 employees. There are exceptions for sole director companies or director only companies where one or less of them has a contract of employment. Sole trader and partnership businesses who do not have any staff do not have to comply with Auto Enrolment.

All employers will be legally required to automatically enrol certain members of staff into a Qualifying Workplace Pension Scheme and make minimum contributions to it. Other staff who are not legally required to enrol can choose to opt in if they wish. Employers who already have an existing pension scheme in place may need to make changes to it so that it complies with the new regulations, which will be policed and enforced by the Pensions Regulator.

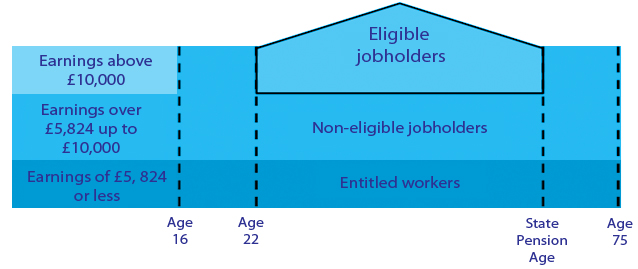

Eligible Jobholders (aged between 22 and state pension age) – automatically enrolled

Non-eligible Jobholders – have the right to opt in and receive employer contributions

Entitled Workers – can join but not entitled to employer contributions

MINIMUM CONTRIBUTIONS

Staging Date to 05/04/2018 06/04/2018 to 05/04/2019 06/04/2019 onwards Employee 0.8% 2.4% 4.0% HMRC 0.2% 0.6% 1.0% Employer 1.0% 2.0% 3.0% Total 2.0% 5.0% 8.0%The point at which your Automatic Enrolment duties start is called your “Staging Date” and is when the law comes into effect for your business. The Pensions Regulator will write to you to alert you of what is happening and to confirm your staging date. You can also find out your staging date on the government website.

The Government has set a number of staging dates as follows:

Large Employers 250+ staff October 2012 to February 2014 Medium Employers 50 to 249 staff April 2014 to April 2015 Small Employers up to 49 staff June 2015 to August 2017New Employers will start automatic enrolment from May 2017

Approximately 45,000 businesses per month will be staging from January 2016 and it is expected this will create a capacity crunch which will leave you struggling to find an adviser and a scheme. The Financial Management Centre are suggesting businesses plan well in advance of their staging date to make sure they are fully prepared. There are over 30 mandatory pension duties which are time consuming, complex to manage and expensive to run, which include:

- Choosing a qualifying pension scheme

- Assessing your staff to ascertain which category of worker they fall into

- Writing to employees to confirm how Auto Enrolment affects them, ensuring the right information goes to the right category of employee at the right time

- Ensuring contributions are paid correctly and on time

- Completing a declaration of compliance to confirm to the Pensions Regulator that you have fulfilled your legal duties

- Keeping records of your Auto Enrolment activities including all correspondence with the pension provider and employees

Managing the process is continuous as employees have to be reassessed at every pay period. Employers may not induce employees to opt out but the communications must tell them that it is an option, nor can they refuse to employ someone who wants to join the scheme.

Failure to comply will be costly as the Pensions Regulator can issue penalty notices for persistent and deliberate non-compliance starting with a fixed penalty of £400 for not complying with statutory notices or if there is sufficient evidence of a breach of law. Persistent offenders will receive escalating daily penalties for failing to comply with a statutory notice depending on the size of their business:

- Up to 4 employees £50 per day

- 5 to 49 employees £500 per day

- 50 to 249 employees £2,500 per day

- 250 to 499 employees £5,000 per day

- Over 500 employees £10,000 per day

The Pensions Regulator can issue civil penalties if contributions are not paid of up to £5,000 for individuals and £50,000 for organisations.

We have a low cost solution which has been designed to help employers meet their needs in advance of their staging date allowing them to continue running their business without any stress or panic of finding a suitable pension scheme. Our Auto Enrolment solution manages the whole process for you, ensures that you remain compliant and avoid the onerous administration and costly fines. If you have any questions or have received a letter from the Pensions Regulator and you are not sure what to do please contact us. We will be very happy to explain how we can take the hassle of Automatic Enrolment off you.

Auto enrolment prices

From £25 per month + setup fee

With such high numbers of businesses set to stage over the next 18 months or so we do suggest that you act as soon as you can and make sure you beat the rush. If as predicted demand outstrips supply then leaving it until nearer your staging date might be a bad decision, which could make this even more stressful and costly for you.

For more information download our free auto enrolment guide above, or alternatively contact your local office.

Our Plans

All our packages are fully customisable and we offer a fixed price monthly payment schedule - no surprises! This gives you certainty and allows you to spread the cost across the year.

Essential

From

£75

Per month*

Our essential package is suited to all businesses who are looking to ensure compliance with reporting requirements.

Professional

From

£300

Per month*

Take away the burden of managing finances and start focusing more on your business by investing in our professional package

Ultimate

From

£750

Per month*

Completely outsource your accounts whilst still maintaining a close eye on company performance with our ultimate package

* Fees vary depending on the size and need of the client business. Packages can be tailored so please contact us to discuss your requirements.

How can we help you

We recognise that not all businesses are the same and will be at different stages of their development. We offer a wide range of services to small-to-medium-sized businesses.

Startup

Finding the right accountant to help you look after your new business's financial side is a key decision that could save you a lot of time and money.

Learn MoreSole Trader

Sole traders are independent business people with drive and ambition. It is important that you use a dedicated accountant who understands that.

Limited Company

Whether you are a small-to-medium-sized business or need a fully dedicated accountant to help meet the challenges faced by limited companies, we can help.

Partnerships

Partnerships bring certain complexities, especially when setting up with family or friends. We understand partnerships and help you grow the business together.

Learn More