Published: January 7th, 2022 in Finance News, Latest News

A recent change in interest rates has caused late payment fees to increase by 0.25%. The Bank of England’s base rate went up from 1% on December 16th last year, and it is now at 2%, which means that if you’re not paying your debts on time, they will cost you more money.

As these extra costs accumulate over time and with an average balance. Eventually, there could be severe consequences for not meeting financial obligations like repaying credit card debt or car loans before maturity dates–significantly when those penalties can quickly add thousands to your outgoings.

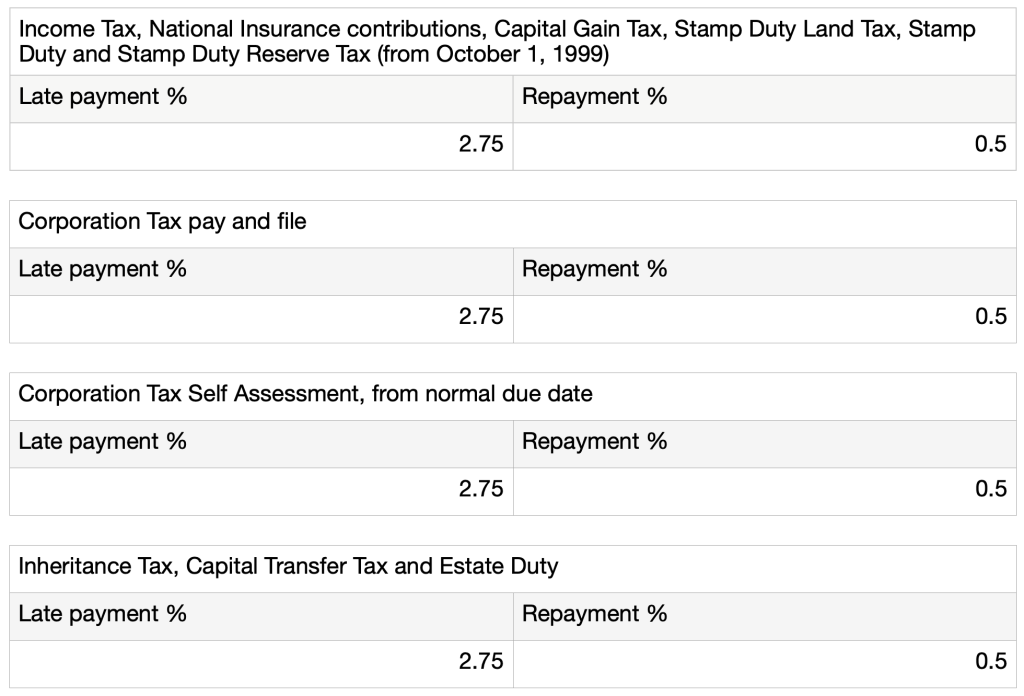

From December 27th 2021, the rate for late payments of taxes and duties administered by HMRC will be 1.25%. This increase is effective immediately, but it applies only to quarterly instalment payment schedules beginning in January 2022. When interest on these other types of loans shoot up from 2% over standard rates, set forth priorities such as paying down outstanding balances more quickly or keeping you better informed about how much money we’ve got sitting around with your name written all over them.

The UK’s smallest businesses will continue to enjoy low-interest rates on their loans, with the rate staying at 0.5%. This is currently set as 5% plus one percent equals 7%, but this can change depending upon what banks are offering right now – which has changed over time according to historical data from mortgages through England’s central bank. There remains little difference between HMRC payers’ current lending practices versus those before them because they’re still using base prices rather than market-sensitive ones found during times where inflation was higher than today.