Published: October 25th, 2021 in Budget/Finance News, Finance News

Previously we have broken down how to interpret the fuel scale charges but these figures have since changed so we are here to provide all the updated information you will need.

How Fuel Scale Charges Work

All VAT registered companies that provide fuel for their employees when they use company vehicles are eligible to recover VAT on fuel used for business purposes via input tax and then account for the VAT applying to private use using fixed charges. You simply add the appropriate charge to your output tax.

This system has been in place for some time but as of May 1st 2021, the rates changed.

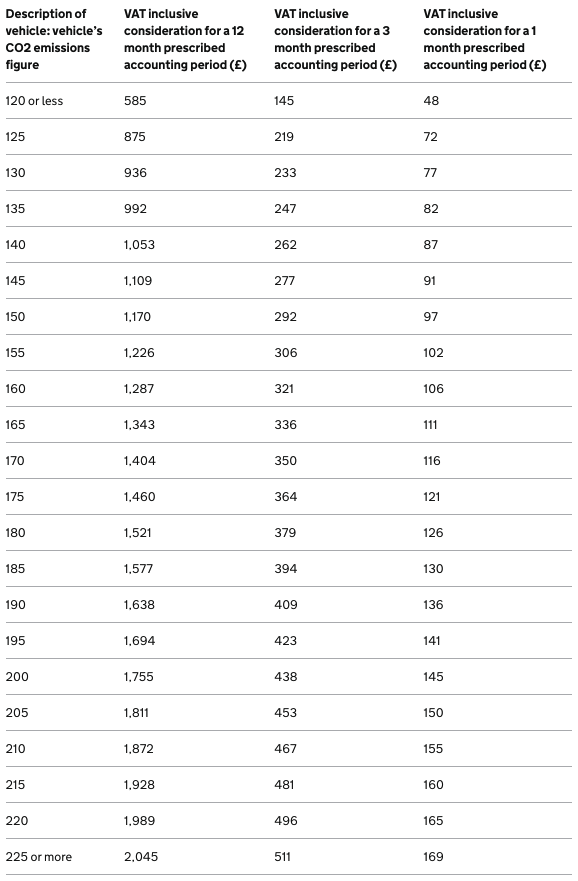

Making Sense Of The Fuel Scale Charges Table

To begin calculating you will need the vehicle’s CO2 emissions and then the table states the amount of VAT due on a monthly, quarterly or annual basis in accordance with your VAT periods.

Click here if you do not have this information to hand. Simply enter in your vehicle registration and the DVLA’s system will reveal the correct emissions for your vehicle.

When the CO2 emission figure is not a multiple of 5, the figure is rounded down to the next multiple of 5 to determine the level of charge.

For bi-fuel vehicles, you will have 2 CO2 emission figures. In this instance, you will use the lower of the 2 figures. And finally, for cars that are too old to have CO2 emissions, you should identify the CO2 band based on the engine size,

- 1,400cc or less – use CO2 band 140

- 1401cc to 2,000cc – use CO2 band 175

- 2000cc or above – use CO2 band 225 or more

And the second figure you will need the VAT accounting period, either 1 month, 3 months or 12 months.

Using the 2 figures you can easily read the table and find your VAT inclusive figure.

When To Avoid VAT Fuel Scale Charges

If your fuel costs are low, you may wish to avoid VAT Fuel Scale Charges. Why? Because the Fuel Scale Charges will be greater than the VAT you wish to reclaim, effectively resulting in a loss. However, if you elect to not utilise the Charges, you must follow this policy for all of your company vehicles. You cannot ‘cherry pick’ different rules for different vehicles in order to avoid paying tax.

Further Information

For further information and help you might find the following links useful:

- The Financial Management Centre’s VAT Return services

- VAT road fuel scale charges from 1 May 2021 to 30 April 2022

Getting Help

If this confuses you, why not opt for The Financial Management Centre’s affordable and reliable VAT return service. This service is inclusive of Road Fuel Scale Charges.