The Financial Management Centre in Crawley offers a tailored payroll and CIS payroll service to the area’s vibrant business community. Outsourcing your payroll could be the most productive decision you make this year. Many Crawley-based businesses claim back hundreds of hours of their precious time by choosing to outsource payroll to our knowledgeable team. We keep updated on HMRC’s many rules so you do not fall foul of subtle changes in the law.

FREE UP YOUR PRECIOUS TIME

Many businesses unwisely choose to delegate payroll responsibilities to their already busy staff members. Payroll may overwhelm your staff. This often results in payroll errors. In turn these errors have knock-on effects capable of damaging your relationship with HMRC and your own employees alike. A classic payroll error involves the under or overpayment of wages. Either scenario is likely to soil relationships with your staff. When you outsource your payroll to The Financial Management Centre you make sure payroll is correct one-hundred percent of the time. We utilise modern payroll software backed up by qualified payroll experts. The result is an accurately managed payroll service you can rely on.

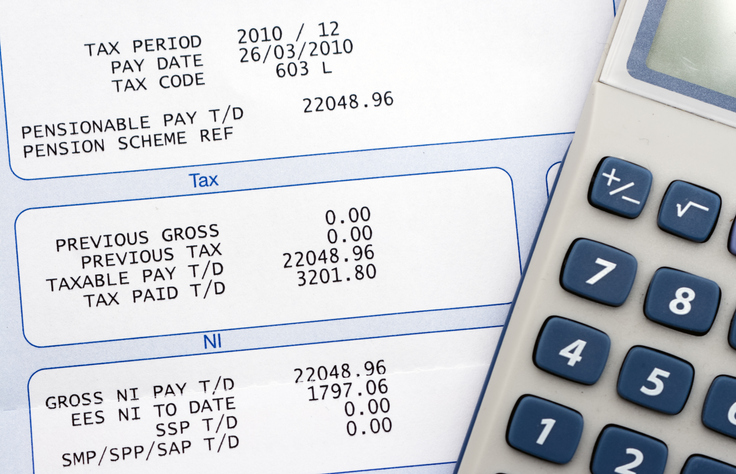

All PAYE and NI is communicated to HMRC using Real Time Information (RTI). We calculate PAYE and NI on your behalf, making revision from time-to-time to reflect changes in the law. We also prepare and send employees payslips. Payslips are marked up with your company logo. We supply e-slips or security sealed payslips depending on your preference.

WHAT THIS SERVICE INCLUDES

Our payroll service includes the below list of features and benefits:

- Payslips – e-slips and security slips. All payslips are customised to your banding

- Telephone support should you need our immediate assistance

- Calculation of PAYE and NI contributions for each employee

- Real Time Information (RTI) submissions to HMRC

- Student loan payments on behalf of employees

- P60, P14 and P35 submissions to HMRC

- Adding and purging employees from payroll

CIS PAYROLL SUPPORT FOR CRAWLEY CONTRACTORS AND SUBCONTRACTORS

The Financial Management Centre also offers a bespoke CIS payroll service, tailored to the needs of local contractors. Contractors are legally obliged to deducted subcontractors’ PAYE and NI at source. HMRC takes a dim view of contractors failing to meet this important requirement. When you outsource CIS payroll to Crawley’s The Financial Management Centre, you ensure your legal responsibilities in this area are taken care of. We transfer funds to HMRC on your behalf and provide your subcontractors with payslips carrying your company logo.

WHAT OUR CIS PAYROLL SERVICE COVERS

Our CIS service will carry out the below list of activities on your behalf:

- We will register contractors for the CIS scheme with HMRC

- Verify your subcontractors with HMRC

- We can produce statements of payments & deductions and on monthly / quarterly basis

- Complete your monthly return and submit to HMRC

- Offer general advice concerning all aspects of CIS

CALL TODAY FREE ON 01293 764 031

Call the team here at The Financial Management Centre on 01293 764 031 for more information on our payroll or CIS payroll services. As well as in Crawley, The Financial Management Centre has established branches all across the United Kingdom. Click here to learn the location of your local centre. Alternatively fill out the enquiry form.

Our Plans

All our packages are fully customisable and we offer a fixed price monthly payment schedule - no surprises! This gives you certainty and allows you to spread the cost across the year.

Essential

From

£75

Per month*

Our essential package is suited to all businesses who are looking to ensure compliance with reporting requirements.

Professional

From

£300

Per month*

Take away the burden of managing finances and start focusing more on your business by investing in our professional package

Ultimate

From

£750

Per month*

Completely outsource your accounts whilst still maintaining a close eye on company performance with our ultimate package

* Fees vary depending on the size and need of the client business. Packages can be tailored so please contact us to discuss your requirements.

How can we help you

We recognise that not all businesses are the same and will be at different stages of their development. We offer a wide range of services to small-to-medium-sized businesses.

Startup

Finding the right accountant to help you look after your new business's financial side is a key decision that could save you a lot of time and money.

Learn MoreSole Trader

Sole traders are independent business people with drive and ambition. It is important that you use a dedicated accountant who understands that.

Limited Company

Whether you are a small-to-medium-sized business or need a fully dedicated accountant to help meet the challenges faced by limited companies, we can help.

Partnerships

Partnerships bring certain complexities, especially when setting up with family or friends. We understand partnerships and help you grow the business together.

Learn More